Livestrong.com Cheesewhat Cheese Can People With Migraines Eat Livestrong.com

17:32

Summary

Here are today's main stories:

17:32

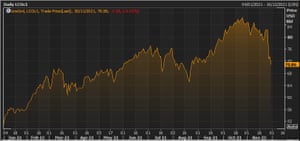

US crude oil has fallen over 6% today, dropping to a three-month low of $65.65 per barrel tonight.

The Opec+ group is meeting later this week, and must weigh up the impact of omicron on future energy demand.

Javier Blas (@JavierBlas)OIL MARKET: WTI and Brent dropping more than 6% on the day, giving more and more reasons to OPEC+ to think twice about what it does on Wed-Thu. Over the last month, oil is down >20% | #OOTT

November 30, 2021

17:20

Here are the key points from Jerome Powell and Janet Yellen's session at the Senate today, via Bloomberg.

- Powell indicates taper could end a few months sooner

- Powell says it's time to retire the word 'transitory' for inflation

- Powell says price pressures have moved beyond Covid trigger

- Yellen warns of recession if debt limit not addressed

- Yellen links recovery's progress to fight against pandemic

And here's the reaction on Wall Street:

Katherine Ross (@byKatherineRoss)very few stocks managing to stay green today pic.twitter.com/fBTAVcn1BZ

November 30, 2021

17:13

FTSE 100 posts worst month in a year

After a turbulent day, stock markets across Europe have ended lower.

Shares were hit by worries about the Omicron variant, following the warning from Moderna's CEO about vaccine efficacy.

The prospect of America's central bank ending its stimulus bond-buying programme sooner than expected also hit stocks.

The UK's FTSE 100 index has closed 50 points lower at 7059 points, wiping out most of Monday's recovery.

That means it has lost 2.5% during November, mainly due to last Friday's plunge, the worst month since October 2020.

Mining stocks led the risers, while fallers included catering group Compass (-3.9%), InterContinental Hotels (-3.3%).

Germany's DAX lost 1.2%, and France's CAC fell by 0.8%, while Spain's IBEX lost 1.8%.

Danni Hewson, AJ Bell financial analyst, says that Covid-19 uncertainty weighed on the markets today.

It's difficult for investors to figure out what moves to make when even the clever folk that make vaccines seem to be at odds over exactly where we are when it comes to fighting the fight against Omicron. Will existing vaccines work? Will they need to be tweaked? How quickly can that happen? So many questions troubling markets, governments, and people. Of the big pharma Covid names only Pfizer's been in positive territory with its share price after the boss said it was not only working on a vaccine with the new variant in mind but that it was confident its Covid treatment pill would already be effective against Omicron.

"Whether it was variant vagaries or a taper tantrum, Wall Street's main indices declined in some choppy trading waters. Increased restrictions might give central banks pause but the pressure of inflation won't just pop gently out of existence and there was very little joy to be had particularly on the Nasdaq, which struggled to find a stock on the rise in early trading.

Shares are falling faster in New York too, where the Dow is now down 600 points.

The Wall Street Journal (@WSJ)The Dow fell more than 600 points after Fed chief Powell said the central bank could end bond purchases sooner amid inflation risks https://t.co/Bp4JQwvzFn

November 30, 2021

17:05

Here's a clip of Jerome Powell warning about the rising risk of inflation:

Yahoo Finance (@YahooFinance)"Generally, the higher prices we're seeing are related to the supply and demand imbalances," Fed Chair Powell says. "But it's also the case that price increases have spread much more broadly in the recent few months… and I think the risk of higher inflation has increased." pic.twitter.com/OZnbXRPfEN

November 30, 2021

Brian Cheung (@bcheungz)November 30, 2021Markets are down after Fed Chairman Jay Powell's remarks suggesting the central bank could still accelerate the taper despite Omicron worries.

Fitch Chief Economist Brian Coulton: "This does sound like a significant change of tone from Powell."https://t.co/mzGgNRLT1q

16:58

Jerome Powell's surprisingly hawkish comments about potentially ending the US central bank's bond-buying stimulus programme early have "upended markets".

So says Matt Weller, global head of research at FOREX.com and City Index.

He thinks chairman Powell has grown "dramatically more concerned" about the risk of sustained inflation, and is therefore looking to end the central bank's asset purchases sooner than initially outlined.

Weller says:

Powell's comments have already sent a tempest through major markets. US indices, fearing the accelerated end of the easy money train, are testing their lowest levels of the month while the yield on the benchmark 10-year Treasury bond has spiked 6bps off its intraday lows to 1.47%.

Gold has shed a quick 30 points to trade back near $1775 and WTI crude oil is losing 4.5% on the day. In FX land, the US dollar surged nearly 100 pips from its intraday lows and is once again trading higher against its major rivals on the week

16:25

Dollar jumps as Fed's Powell hints at earlier tapering

Fed chair Jerome Powell has jolted the markets, by indicating that the central bank could wind up its stimulus programme faster than planned.

In his testimony to the Senate Banking Committee, Powell said it could be appropriate to wrap up the Fed's bond-buying programme more speedily, despite the omicron variant.

"At this point, the economy is very strong, and inflationary pressures are high.

"It is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at our November meeting, perhaps a few months sooner."

The Fed decided to cut its $120bn/month bond-buying stimulus programme by $15bn this month, and again in December. At that pace, the tapering would end in June.

Powell, though, is signaling a faster taper - which could hurt asset prices, which have benefited from the Fed's money-printing.

Gregory Daco (@GregDaco)November 30, 2021#Omicron developments have not poured cold water on the Fed's intent to accelerate the tapering of its QE asset purchase program

Communication from #Fed Chair #Powell indicates pace could be doubled starting in January (from $15bn to $30bn/mo) w/ possible December announcement https://t.co/hvOw8VrMRx

Tom Graff (@tdgraff)That means the taper acceleration is a done deal. The Chair doesn't idly speculate on this kind of stuff. https://t.co/zTn7ZMOkGS

November 30, 2021

The dollar has now jumped higher, wiping out its earlier losses and pulling the pound down to a new 11-month low of $1.323.

16:12

The threat of a strike action at one of the UK's biggest oil refineries has ended, after a new pay deal was agreed.

Staff at the Stanlow oil refinery in Ellesmere Port have reached an agreement with owners Essar covering pay, bonuses and pensions, after last month voting overwhelmingly to strike.

The deal means workers will get a backdated pay increase from January 2021 of 1.5% (the retail price index (RPI) rate for the October 2020 +0.2%), plus a further pay increase of 6.2% (the current RPI rate + 0.2%) from January 2022.

Unite regional co-ordinating officer Mick Chalmers said:

"The fantastic ballot result by our members was the catalyst to ensure that Essar had to enter into serious negotiations and a fair resolution could be agreed.

"This deal is important in the long-term as it will greatly assist in the transition of Stanlow from being an oil refinery into a hub for low carbon energy."

16:05

Michael Hewson 🇬🇧 (@mhewson_CMC)November 30, 2021So we've gone from Moderna - "not looking good" to

BioNTech's Sahin - variant could lead to more infections, but vaccinated people likely remain protected from severe disease.

Good news..

15:51

European stock markets are staging a recovery in late afternoon trading.

After a session dominated by omicron concerns, the pan-European Stoxx 600 index is now flat, after the founder of BioNTech predicted that Omicron is unlikely to cause severe illness in vaccinated people.

The UK's FTSE 100 has recovered most of its losses, now down only 0.3% today. It had lost over 1.6% at one stage. Heavyweight stocks such as miners and banks are in the risers.

The smaller FTSE 250 index is lagging, though, down 0.5%.

15:48

Omicron unlikely to cause severe illness in vaccinated people -- BioNTech founder

The co-founder of BioNTech, which created Pfizer's Covid-19 vaccine, has predicted that vaccinated people will still be protected from severe disease from Omicron.

Ugur Sahin said that while the variant could lead to more infections, vaccinated people are likely to remain protected from becoming severely ill, so governments should press on with rolling out booster shots, fast.

That's an encouraging prediction, which could offer reassurance to those concerns about Omicron.

The Wall Street Journal has the story:

The Omicron variant of the coronavirus could lead to more infections among vaccinated people but they will most likely remain protected from a severe course of illness, according to the inventor of one of the first Covid-19 vaccines.

While the new variant might evade the antibodies generated in reaction to the vaccine, the virus will likely remain vulnerable to immune cells that destroy IT once it enters the body, BioNTech SE co-founder Ugur Sahin said.

"Our message is: Don't freak out, the plan remains the same: Speed up the administration of a third booster shot," Dr. Sahin said in an interview Tuesday.

Based on current knowledge about the mechanisms behind the vaccine and the biology of variants, Dr. Sahin said he assumed that immunized people would have a high level of protection against severe disease even if infected by the Omicron variant.

Giovanni Staunovo🛢 (@staunovo)Omicron Unlikely to Cause Severe Illness in Vaccinated People, BioNTech Says

November 30, 2021

Variant could lead to more infections but vaccinated people likely remain protected from severe disease, Ugur Sahin says#oott https://t.co/JR1Zf6irez

Bojan Pancevski (@bopanc)While the Omicron might evade the antibodies generated in reaction to the vaccine, the virus will likely remain vulnerable to immune cells (T-cells) that destroy it once it enters the body, @BioNTech_Group co-founder Ugur Sahin said. https://t.co/NqFQbh9QPX

November 30, 2021

Bojan Pancevski (@bopanc)"Our message is: Don't freak out, the plan remains the same: Speed up the administration of a third booster shot," Dr. Sahin said in an interview Tuesday. https://t.co/xq9DHdxf78

November 30, 2021

15:22

US consumer confidence at nine-month low

U.S. consumer confidence slipped in November amid concerns about the rising cost of living and the ongoing pandemic.

The Conference Board's gauge of consumer morale dropped to 109.5 this month from 111.6 in October. That's a bigger drop than forecast, to the lowest level since February.

Spreadex (@spreadexfins)USA Consumer Confidence announcement - Actual: 109.5, Expected: 111.0 pic.twitter.com/a1Zvv6GHyA

November 30, 2021

The survey was conducted before the discovery of Omicron was announced last week.

It shows that concerns about inflation were already hitting confidence, with people less optimistic about economic prospects, and the current situation.

The Present Situation index fell to 142.5 in November from October's downwardly revised reading of 145.5 from 147.4. Meanwhile, the US Consumer Expectations index fell to 87.6 in November from 89.0 in October.

Liz Ann Sonders (@LizAnnSonders)November @Conferenceboard Consumer Confidence Index fell to 109.5 vs. 110.9 est. & 111.6 in prior month (rev down from 113.8); expectations component fell further to 87.6 vs. 89 prior, but present situation also fell, resulting in minor uptick in spread between both pic.twitter.com/Ysm2gxoqFZ

November 30, 2021

15:05

The US dollar has weakened today, indicating that traders believe Omicron will deter the Federal Reserve from raising interest rates as quickly as expected.

Pandemic uncertainty could also discourage the Fed from cutting its bond-buying stimulus programme at a faster pace.

Asif Abdullah (@Asif_H_Abdullah)After Omicron fears since last Friday, based on Fed Funds Futures pricing, market has taken off one rate hike from its rate hike expectations. pic.twitter.com/cipE49ladv

November 30, 2021

The pound has gained half a cent against the dollar to $1.336, away from the 11-month lows seen last week.

14:49

Shares in Moderna have dropped by 7% in early trading.

Traders are digesting CEO Stéphane Bancel's prediction that it would take months before pharmaceutical companies can manufacture new variant-specific jabs at scale.

Moderna's share had surged last Friday, and again yesterday, after governments announced travel restrictions following the discovery of the Omicron variant.

14:45

Wall Street has opened in the red, following the Moderna CEO's warning that existing vaccines could struggle to tackle Omicron as well as earlier strains.

However, it's not as steep a fall as feared a few hours ago.

The Dow Jones industrial Average of 30 large US firms has dropped by 238 points, or 0.7%, to 34,897 points.

The broader S&P 500 index is also down 0.7%, while the tech-focused Nasdaq is only down 0.3%, with tech stocks holding up well.

The financial, utilities, healthcare and real estate sectors are lagging behind.

14:30

Brent crude drops towards $70/barrel

Concerns that the omicron variant will hit energy demand are pulling the oil prices lower.

Brent crude is now down 3.5% today at $70.86 per barrel, the lowest since the start of September, amid fears of new travel restrictions and other curbs.

Oil has fallen steadily since Brent hit three-year highs in October, following the rise in Covid-19 cases in Europe.

Craig Erlam, analyst at OANDA, says oil prices are unsurprisingly taking another hit as risk sentiment turns negative once again.

Brent crude is closing in on $70 now - which looks a big support level - as traders continue to fret about the efficacy of the current vaccines and what it means for the global economy in the coming months. WTI has slipped below but could see some support around $67 after such a severe drop.

14:19

Elsewhere in the markets, the Turkish lira has slid over 2% today towards last week's record lows.

The lira weakened, again, after Turkey's president, Recep Tayyip Erdoğan, pledged he would never defend interest rate hikes nor compromise on the issue, after recent rate cuts hammered the lira.

Robin Brooks (@RobinBrooksIIF)Turkish Lira is down 37% against US Dollar in November. Depreciation was relatively modest until the CBRT rate cut November 18, since when it has accelerated. This fall in Lira is a "sudden stop" in capital inflows, which will hurt activity & bring recession. With @UgrasUlkuIIF pic.twitter.com/pYvn8lDO4m

November 30, 2021

Victoria Scholar, head of investment at interactive investor, warns that the risk of hyperinflation is growing.

If it wasn't already clear enough that Erdogan doesn't believe in basic economic theory that inflation can be controlled by interest rates, Turkey's President has let us know once again that he will never defend higher interest rates and that he will never compromise on this issue.

Its central bank, which suffers from a lack of independence, has cut its main interest rate three months in a row, despite eyewatering inflation levels of nearly 20%. The country's inflationary backdrop combined with loosening monetary policy is sharply increasing the risk of hyperinflation, a phenomenon that is deeply troublesome for living standards by destroying the purchasing power of money.

The Turkish lira has gained in just one session out of the last eight against the US dollar and is trading close to record lows, reflecting the painful inflationary picture. USDTRY continues its upward ascent, pushing higher by more than 2% today, extending its rally to 37% this month alone. The next major resistance hurdle is at 13.45, the all-time low for the lira hit last week after President Erdogan said Turkey was fighting an 'economic war of independence'.

Victoria Scholar (@VictoriaS_ii)November 30, 2021$USDTRY continues its ascent with the #lira shedding 37% since the start of November with just one daily red candle in the last 8 $USDTRY is inching closer to key resistance at 13.45 the all-time high logged last week

Erdogan said he will never compromise on interest rates pic.twitter.com/3aWcXY7tQQ

Livestrong.com Cheesewhat Cheese Can People With Migraines Eat Livestrong.com

Source: https://www.theguardian.com/business/live/2021/nov/30/markets-moderna-covid-vaccines-omicron-ftse-inflation-jerome-powell-business-live